Health Insurance and Health Services

Medicare

Since early in this century, health care issues have continued to escalate in importance for our Nation. Beginning in 1915, various efforts to establish government health insurance programs have been initiated every few years. From the 1930's on, there was a broad agreement on the need for some form of health insurance to alleviate the unpredictable and uneven incidence of medical costs. The main health care issue at that time was whether health insurance should be privately or publicly financed.

Private health insurance coverage expanded rapidly during World War II, when fringe benefits were increased to compensate for the government limits on direct wage increases. This trend continued after the war. Private health insurance (mostly group insurance financed through the employment relationship) was especially needed and wanted by middle income people. Yet not everyone could obtain or afford private health insurance. Government involvement was sought.

Various national health insurance plans, financed by payroll taxes, were proposed in Congress starting in the 1940's, but none was ever brought to a vote. After various considerations and approaches, and following lengthy national debate, Congress passed legislation in 1965 that established the Medicare program as Title XVIII of the Social Security Act.

The 1965 amendments to the Social Security Act established two separate but coordinated health insurance plans for persons aged 65 or older. The compulsory Hospital Insurance (HI) program is Part A of Medicare, and a voluntary program of Supplementary Medical Insurance (SMI) is Part B. Various legislation has extended HI protection to certain disabled persons under age 65 and to persons of any age with end-stage kidney disease.

Since 1977, the Health Care Financing Administration (HCFA) has had primary program and administrative responsibility for Medicare. Two trust funds (one for HI and one for SMI), which are funded differently, finance the program.

In 1995, more than 37 million persons were enrolled for Part A, and 36 million for Part B. Benefit payments for 1995 totaled $184.2 billion, of which Part A accounted for $117.6 billion and Part B accounted for $66.6 billion.

Of those persons who were entitled to Medicare in 1995, more than 84% used Part B services, while only 22% used Part A. The combined HI and SMI benefit payments for all Medicare services averaged $4,978 per enrollee.

| Type of coverage | Persons enrolled (in thousands) | ||

|---|---|---|---|

| All persons | Aged | Disabled | |

| Hospital Insurance and/or Supplementary Medical Insurance | 37,980 | 33,359 | 4,621 |

| Hospital Insurance | 37,567 | 32,947 | 4,620 |

| Supplementary Medical Insurance | 36,104 | 31,949 | 4,155 |

Eligibility for Benefits

Part A

Persons are eligible for Hospital Insurance protection when they reach age 65 if they are eligible for monthly Social Security benefits. Persons covered by the Railroad Retirement system participate in the HI program on the same basis as those under the Social Security system.

Also eligible are those who would receive a monthly Social Security benefit if their governmental employment were covered work under Social Security. Persons under age 65 who are disabled are eligible for HI if they have been entitled to Social Security disability benefits for more than 24 months or would be entitled to such benefits if their governmental employment were covered work under the Social Security Act. Persons at any age with end stage kidney disease and who meet the special insured status requirements under Social Security are also eligible for HI.

Persons aged 65 or older who are not eligible for benefits may purchase HI coverage for a monthly premium of $187 if they have 30–39 quarters of Social Security coverage. For those with less than 30 quarters of coverage, the monthly premium is $311. Enrollment in Part B is required as a condition for “buying into” the HI program. Another requirement is that the person must be a U.S. resident and either a citizen or alien admitted for permanent residence and have resided in the United States for at least 5 years at the time of application for enrollment in Medicare.

Part B

Supplementary Medical Insurance benefits are available to nearly all resident citizens (and certain aliens) aged 65 or older and to disabled beneficiaries who are entitled to Part A. Part B coverage is optional and must be paid for through a monthly premium ($43.80 in 1997), which is deducted from the enrollees' Social Security benefit, Railroad Retirement annuity, or Federal Civil Service Retirement annuity. Enrollees not yet receiving such benefits—generally public assistance recipients—are billed quarterly. They individually pay the premium, or a State social service or medical assistance agency pays the premium on their behalf. Coverage will be terminated for failure to pay the premium. Enrollment in Part B also can be terminated by the individual by filing a notice with the Social Security Administration.

Persons who withdraw from the program before coverage starts incur no premium liability. However, the premium rate is increased by 10% for each full year out of the program for persons who do not enroll as soon as they are eligible. (Special waivers of the premium surcharge are available to employees or spouses who continue coverage under an employer-sponsored health insurance plan.)

Covered Services

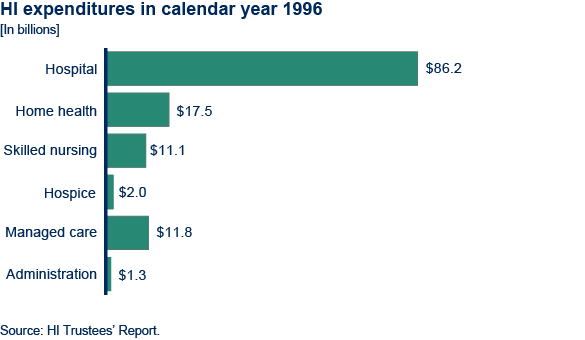

Part A covers inpatient hospital services, care in skilled nursing facilities, home health services, and hospice care.

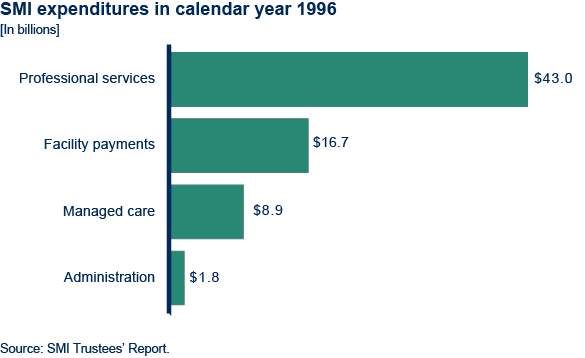

Part B is often thought of primarily as coverage for physician services (in both hospital and nonhospital settings). However, it also covers certain other nonphysician services such as clinical laboratory tests, durable medical equipment, flu vaccinations, drugs that cannot be self-administered (except certain anticancer drugs), most supplies, diagnostic tests, ambulance services, certain other health care services, and blood that is not supplied under Part A. All services must be medically necessary to be covered.

Medicare does not pay for the following: long-term nursing care; most outpatient prescription drugs and patent medicines; dental care; eyeglasses, hearing aids, and examinations to prescribe or fit them; routine physical checkups; routine foot care; cosmetic surgery; or for a telephone, television, or radio in a patient's hospital room. Although these services are not covered under Part A or Part B, they may be covered as part of a managed care plan (described below).

Medicare does not pay for services provided outside the United States and its territories (except for services obtained in Canadian or Mexican hospitals when such facilities are closer to or substantially more accessible from the person's residence than the nearest adequately equipped hospital in the United States).

| Services | Benefit | Medicare pays | Patient pays |

|---|---|---|---|

| Hospitalization Semiprivate room and board, general nursing and other hospital services and supplies. (Medicare payments based on benefit periods.) |

First 60 days | All but $760 | $760 |

| 61st to 90th day | All but $190 a day | $190 a day | |

| 91st to 150th day* | All but $380 a day | $380 a day | |

| Beyond 150 days | Nothing | All costs | |

| Skilled nursing facility care Semiprivate room and board, skilled nursing and rehabilitation services and other services and supplies.** (Medicare coverage based on benefit periods.) |

First 20 days | 100% of approved amount | |

| Additional 80 days | All but $92 a day | ||

| Beyond 100 days | Nothing | ||

| Home health care Part-time or intermittent skilled care, home health aide services, durable medical equipment and supplies and other services. |

Unlimited as long as you meet Medicare requirements. | 100% of approved amount; 80% of approved amount of approved amount for durable medical equipment. | Nothing for services; 20% of approved amount for durable medical equipment. |

| Hospice care Pain relief, symptom management and support services for the terminally ill. |

For as long as doctor certifies need. | All but limited costs for outpatient drugs and inpatient respite care. | Limited cost sharing for outpatient drugs and inpatient respite care. |

| Blood When furnished by a hospital or skilled nursing facility during a covered stay. |

Unlimited during a benefit period if medically necessary. | All but first 3 pints per calendar year. | For first 3 pints.*** |

| * 60 reserve days may be used only once. | |||

| ** Neither Medicare nor Medigap insurance will pay for most nursing home care. | |||

| *** To the extent the 3 pints of blood are paid for or replaced under one part of Medicare during the calendar year, they do not have to be paid for or replaced under the other part. | |||

| Source: Updated for 1997 rates from 1996 Guide To Health Insurance for People with Medicare, National Association of Insurance Commissioners and the Health Care Financing Administration, U.S. Department of Health and Human Services. | |||

| Services | Benefit | Medicare pays | Patient pays |

|---|---|---|---|

| Medical expenses Physician's services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, durable medical equipment and other services. |

Unlimited if medically necessary. | 80% of approved amount (after $100 deductible). 50% of approved amount for most outpatient mental health services. |

$100 deductible,* plus 20% of approved amount and limited charges above approved approved amount.** 50% for most mental health services. |

| Clinical laboratory services Blood tests, urinalysis, and more. |

Unlimited if medically necessary. | Generally 100% of approved amount. | Nothing for services. |

| Home health care Part-time or intermittent skilled care, home health aide services, durable medical equipment and supplies and other services. |

Unlimited as long as you meet Medicare requirements. | 100% of approved amount; 80% of amount Medicare approves for durable medical equipment. | Nothing for services; 20% of amount Medicare approves for durable medical equipment (after $100 deductible). |

| Outpatient hospital treatment Services for the diagonosis or treatment of an illness or injury. |

Unlimited if medically necessary. | Medicare payment to hospital based on hospital costs. | 20% of billed amount (after $100 deductible).* |

| Blood | Unlimited if medically necessary. | 80% of approved amount (after $100 deductible and starting with 4th pint). | First 3 pints plus 20% of approved amount for additionalpints (after $100 deductible).*** |

| * Once you have had $100 of expense for covered services, the Part B deductible does not apply to any covered services you receive for the rest of the year. | |||

| ** Federal law limits charges for physician services. | |||

| *** To the extent any of the 3 pints of blood are paid for or replaced under one part of Medicare during the calendar year, they do not have to be paid for or replaced under the other part. | |||

| Source: Updated for 1997 rates from 1996 Guide To Health Insurance for People with Medicare, National Association of Insurance Commissioners and the Health Care Financing Administration, U.S. Department of Health and Human Services. | |||

| A | B | C | D | E | F | G | H | I | J |

|---|---|---|---|---|---|---|---|---|---|

| Basic | Basic | Basic | Basic | Basic | Basic | Basic | Basic | Basic | Basic |

| Skilled nursing | Skilled nursing | Skilled nursing | Skilled nursing | Skilled nursing | Skilled nursing | Skilled nursing | Skilled nursing | ||

| Part A | Part A | Part A | Part A | Part A | Part A | Part A | Part A | Part A | |

| Part B | Part B | Part B | |||||||

| Part B excess | Part B excess | Part B excess | Part B excess | ||||||

| Foreign travel | Foreign travel | Foreign travel | Foreign travel | Foreign travel | Foreign travel | Foreign travel | Foreign travel | ||

| At home | At home | At home | At home | ||||||

| Preventive | Preventive | ||||||||

| Note: Basic benefits included in all plans; hospitalization—Part A coinsurance coverage for 365 additional days after Medicare benefits end; medical expenses—Part B coinsurance (generally 20% of Medicare approved expenses), and blood—first 3 pints each year. | |||||||||

| Source: [1997] Guide for Health Insurance for People with Medicare, National Association of Insurance Commisioners and the Health Care Financing Administration, U.S. Department of Health and Human Services. | |||||||||

Private Plans

Managed Care Plans

Most managed care plans are HMOs, but are also referred to as competitive medical plans. Medicare pays these plans a prospectively set capitation payment to provide covered services to enrolled beneficiaries. The enrollees generally pay a fixed monthly premium and a small copayment instead of Medicare's coinsurance and deductibles.

Managed care plans provide Medicare services through either a “risk” or a “cost” contract. Plans with risk contracts provide the services on a predetermined per person basis regardless of the frequency or extent of health care utilization by the enrollees. Generally, those who join a risk plan are locked into receiving all covered care through the plan or through referrals by the plan.

Plans with cost contracts pro vide Medicare services on a reasonable per person amount based on the actual costs, which are adjusted at year's end. Cost plans do not have lock-in requirements so enrollees can choose a health care provider affiliated with the plan or go outside the plan. However, if the enrollee goes outside the plan, Medicare pays for the services. Medicare pays for it's share of approved charges and the enrollee is responsible for Medicare's coinsurance and deductibles.

Joining a managed care plan and receiving all services through it means the beneficiary's out-of-pocket costs are usually more predictable. Depending on personal health needs, these costs may be less than the beneficiary would have to pay for the regular Medicare deductible and coinsurance amounts. Managed care plans may also offer supplementary benefits not covered by Medicare, such as preventive care, dental care, and products such as hearing aids and eyeglasses. Also, electing to participate in a managed care plan may serve as an alternative to purchasing “Medigap” insurance (described below), which is often wanted if the beneficiary is in a traditional fee-for-service plan.

Medigap

Medigap insurance is specifically designed to supplement health care expenses that are not covered by Medicare. To make it easier for consumers to comparison shop for Medigap insurance, the law limits the number of different policies that can be sold in each State and jurisdiction. The same format, language, and definitions are used to describe the benefits for each of the 10 standard plans that are available.

Other Insurance

Medicare beneficiaries may also have coverage from another source, such as an employer group health plan, veterans benefits, workers' compensation, or black lung benefits. In these cases, Medicare is the secondary payer for health care claims.

Medicare beneficiaries with very low income and resources may get help in paying their cost-sharing portions of Medicare from their States' Medicaid program. (The relationship between Medicaid and Medicare is described in more detail in the Medicaid section.)

Financing and Payments

The financing plan for Part A, Hospital Insurance, is a pay-as-you go system. It requires workers and their employers as well as self-employed persons to pay taxes on earnings in jobs covered by Social Security. The current tax rate of 1.45% applies equally to employees and employers, and the rate for the self-employed equals the combined employer and employee rate of 2.9%.

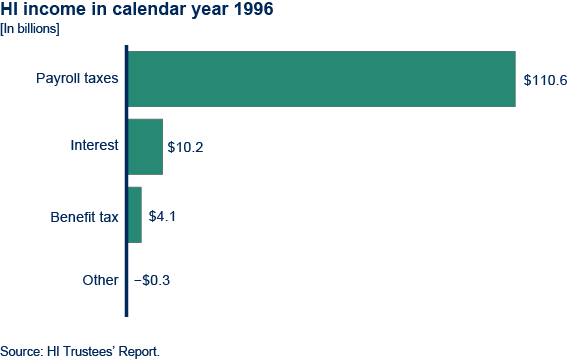

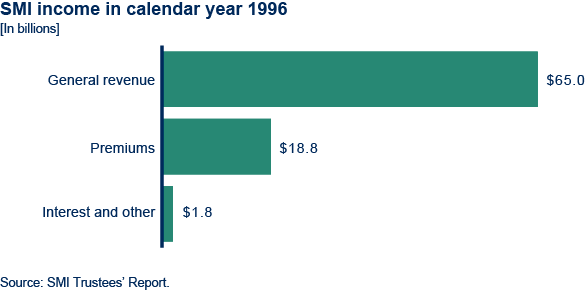

Part B, Supplementary Medical Insurance, is financed by a combination of monthly premiums paid by the beneficiaries ($43.80 in 1997) and Federal general revenues. The income for these programs is deposited into two separate trust funds: the Federal Hospital Insurance Trust Fund for Part A, and the Federal Supplementary Medical Insurance Trust Fund for Part B. These funds are managed in the same manner as the Social Security trust funds.

The rising cost of health care is a major consideration for HCFA, for the President, and for Congress. The present schedule for financing the Part A program is sufficient to ensure the payment of benefits only until early in the year 2001, when the funds are expected to be exhausted. And although the Part B program is currently actuarially sound, the past and projected growth in the cost of the program is of grave concern. The long-range intermediate assumptions are: HI program costs are projected to increase from 1.63% of the GDP in calendar year 1995 to 5.04% of the GDP in calendar year 2070 and the SMI program costs are projected to increase from 0.92% of the Nation's GDP in calendar year 1995 to 3.7% of the GDP in calendar year 2070.

Deductibles and Coinsurance

For Part A, a person's use of hospital and skilled nursing services is measured in terms of a benefit period. A benefit period begins the day the beneficiary is hospitalized, with an initial deductible ($760 in 1997) paid by the beneficiary for the first admission of each benefit period. After 60 days of hospitalization within a benefit period (without a continuous break of 60 days), additional coinsurance is required within the benefit period. A benefit period ends only after 60 days has past since discharge from a hospital or other facility that primarily provides skilled nursing or rehabilitation. If the beneficiary is hospitalized again, a new benefit period begins. Most HI benefits are then renewed, and the beneficiary must pay a new inpatient hospital deductible. The number of benefit periods is unlimited.

For most SMI covered services, the beneficiary is liable for the monthly premium, an annual deductible ($100), and 20% of the cost of the services. For outpatient mental health treatment services and a few other specific services, the beneficiary is liable for 50% of the approved charges.

Vendor Payments

Part A payments for most inpatient hospital care are based on the Prospective Payment System. Under the PPS, a hospital is paid a predetermined rate per discharge. The predetermined rate is based on payment categories called Diagnosis Related Groups, or DRGs. In some cases, the payment will be more than the hospital's costs; in other cases, the payment will be less than the hospital's costs. The hospital absorbs the loss or makes a profit. In cases where the costs for necessary care are unusually high or the length of stay is necessarily unusually long, the hospital receives additional payment. Payments for home health services, hospital care, and for skilled nursing care are made on a “reasonable cost” methodology, with each service or type of care having some restrictions and limitations.

Part B payments to physicians are paid on the basis of “reasonable charge,” which is defined as the lesser of the submitted charges, or a fee schedule based on a relative value scale. Durable medical equipment and clinical laboratory services are based on a fee schedule. Outpatient services and home health agencies are reimbursed on a reasonable “cost” basis.

If a physician or medical equipment supplier agrees to “take assignment” (that is, agrees to accept the Medicare-approved amount as full payment for services), then Medicare pays 80% of the approved amount directly to the physician or supplier after the beneficiary meets the $100 deductible. The beneficiary pays the other 20%. No added payments may be sought from the beneficiary or insurer. If the provider does not take assignment, the beneficiary will be charged for the excess, which may be paid by Medigap insurance. Limits exist on the excess that providers can charge. However, since beneficiaries may select their physicians, they have the option to choose those who take assignment, and thus require no added payments.

Fiscal Intermediaries

HCFA contracts with public or private agencies or organizations to process Part A claims for institutional services and Part B claims for outpatient claims. These “intermediaries” include the Blue Cross/ Blue Shield Association (which uses Blue Cross plans in various States) and commercial insurance companies. The fiscal intermediary determines reasonable costs for covered items and services, makes payments, and guards against unnecessary use of covered services.

Medicare “carriers” handle Part B claims for services by physicians and medical suppliers. They determine reasonable charges, make payments, determine whether claims are covered, and deny noncovered claims and unnecessary use of services. Carriers include State Blue Shield plans and commercial insurance carriers.

To improve the quality and effectiveness of Medicare services, each State has a Peer Review Organization (PRO) that the Federal Government pays to determine, for payment purposes, whether the care is reasonable, necessary, and provided in the most appropriate setting. The PROs are composed of groups of practicing physicians. To receive Medicare payments, a hospital must have an agreement with a Peer Review Organization.

Administration

The Health Care Financing Administration, an agency of the Department of Health and Human Services, is responsible for setting policy and administering the Medicare program. The day-to-day operational work of the program is performed under contract by commercial insurance companies and nonprofit insurers, such as the Blue Cross and Blue Shield plans. These organizations have the responsibility for reviewing and processing benefit claims and making payments to the health care providers. The Social Security Administration does the initial determination of Medicare entitlement. It also provides certain claims-taking and record maintenance services its network of field offices. SSA also provides computer support for the Medicare program.

Medicaid

Title XIX of the Social Security Act (part of the Social Security Amendments of 1965) established the Medicaid program to provide medical and health related services for individuals and families with low incomes through direct payment to suppliers of the program. Medicaid is the largest source of funds for medical care and related services to our Nation's poorest people.

Participation is optional; but all States and the District of Columbia have Medicaid programs. Puerto Rico, Guam, the Northern Mariana Islands, American Samoa, and the Virgin Islands also have some participation in Medicaid. (These other jurisdictions are included when the word “States” is used.)

Medicaid is a cooperative endeavor between each State and the Federal Government, and is financed by shared Federal and State funds. Each Medicaid policy and program plan is also a joint endeavor. Within broad national guidelines established by Federal statutes, regulations, and policies each of the States (1) establishes its own eligibility standards; (2) determines the type, amount, duration, and scope of ser vices; (3) sets the rate of payment for services; and (4) administers its own program. Medicaid policies for eligibility and ser vices are therefore complex, and vary considerably from State to State and within each State over time.

In 1995, more than 36 million persons received Medicaid services. Total outlays amounted to $159.5 billion ($85.5 billion in Federal and $66.3 billion in State funds). Of the total amount, $120 billion was for vendor payments; $14 billion for premium payments (for example, to HMOs and Medicare); and $19 billion was for payments to disproportionate share hospitals.

Eligibility and Coverage

Once eligibility for Medicaid is determined, coverage generally is retroactive to the third month prior to application. Medicaid coverage generally stops at the end of the month in which a person no longer meets the criteria of any eligibility group.

Low income is only one test for Medicaid eligibility; assets and resources also are tested against established thresholds determined by each State. For instance, Medicaid rules for the treatment of income and resources of married couples when one spouse requires nursing home care and the other remains living at home are intended to prevent the impoverishment of the spouse remaining in the community. Before the institutionalized person's money is used to pay for the cost of institutional care, a minimum monthly maintenance needs allowance is deducted for bringing the income of the spouse living in the community up to a moderate level; and a State-determined level of resources is preserved.

Within Federal guidelines, States have broad discretion in determining which groups their Medicaid programs will cover and the financial criteria for eligibility. States must cover “categorically needy” individuals (which usually includes recipients of SSI and families with dependent children receiving cash assistance, as well as other mandatory low-income groups such as pregnant women, infants, and children with incomes less than specified percent of the Federal poverty level) and certain low-income Medicare beneficiaries.

Mandatory Eligibility Groups

States are required to provide Medicaid coverage for certain individuals who receive federally assisted income-maintenance payments, as well as for related groups not receiving cash payments. The following (effective July 1997) displays the mandatory Medicaid eligibility groups:

- Recipients of AFDC.

- Recipients of TANF. (In those States with TANF programs, those individuals who would have met the State's AFDC program's eligibility requirements under rules in effect on July 16, 1996 generally are eligible.)

- Children under age 6 who meet the State's AFDC financial requirements or whose family income is at or below 133% of the Federal poverty level.

- Pregnant women whose family income is below 133% of the Federal poverty level (services are limited to pregnancy, complications of pregnancy, delivery, and 3 months of post-partum care).

- Certain Medicare beneficiaries.

- SSI recipients (or aged, blind, or disabled individuals in States that apply more restrictive eligibility requirements).

- Recipients of adoption assistance and foster care under Title IV-E of the Social Security Act.

- Special protected groups (typically individuals who lose their cash assistance from AFDC or SSI due to earnings from work or increased Social Security benefits, but who may keep Medicaid for a period of time).

- All children born after September 30, 1983, in families with incomes at or below the Federal poverty level who are under age 19. (This phases in coverage, so that by the year 2002, all poor children under age 19 will be covered).

Medicare Beneficiaries.—Medicaid provides help for certain Medicare beneficiaries. This assistance allows low-income beneficiaries to maintain full Medicare coverage.

There are three groups who receive at least some help from the Medicaid program: (1) QMBs (Qualified Medicare Beneficiaries)—persons who have incomes at or below 100% of the Federal poverty level and resources at or below 200% of the SSI limit. (The QMB group includes those who are fully eligible for Medicaid also.) For QMBs, the State pays the Medicare cost sharing expenses subject to the limits that States may impose on payments rates. (2) SLIMBs (Specified Low-Income Medicare Beneficiaries)—persons who meet all QMB requirements except that their incomes are slightly higher. For those persons, the State plan pays only the Medicare Part B premium. (3) QDWIs (Qualified Disabled and Working Individuals)—persons who were formerly qualified as disabled Medicare beneficiaries but whose incomes exceed the maximum for that program because they returned to work (despite their disability) and thus they are no longer eligible for monthly Social Security benefits. Medicaid must pay the Medicare Part A premium for QDWIs whose income does not exceed 200% of the Federal poverty level.

Optional Eligibility Groups

States also have the option of providing Medicaid coverage for certain other “categorically related” groups of persons receiving Federal matching monies. These optional groups share the characteristics of the mandatory groups, but the eligibility criteria are somewhat more liberally defined. These “permissible” groups, for whom Federal matching monies are allowed, include:

- Infants up to age 1 and pregnant women not covered under the mandatory rules whose family income is no more than 185% of the Federal poverty level guidelines. (The exact percentage is set by each State.)

- Children under age 21 who meet the AFDC income and resources requirements.

- Recipients of State supplementary payments.

- Individuals who would be eligible if institutionalized, but who are receiving care under home and community based services waivers.

- Institutionalized individuals eligible under a special income level (the amount is set by each State—up to 300% of the SSI Federal benefits rate).

- Tuberculosis (TB) infected persons who would be financially eligible for Medicaid at the SSI level. (Eligibility is only for TB-related ambulatory services and drugs.)

- Certain aged, blind, or disabled adults who have incomes above those requiring mandatory coverage, but below the Federal poverty level.

- “Medically needy” persons.

Medically Needy.—These persons would be eligible for Medicaid under one of the mandatory or optional groups, except that their income and/or resources are above the eligibility level set by the State. Medically needy income levels are higher than the regular Medicaid eligibility levels; thus, persons may qualify immediately, or may “spend down” by incurring medical and/or remedial care expenses that cause them to be at or below their State's level for this medically needy program.

The medically needy program does not have to be as extensive as the program for the categorically eligible groups, and may be quite restrictive in rules as to who is covered and/or as to what services are offered. Federal matching monies are available. However, if a State elects to have any medically needy program, there are Federal requirements that certain groups and certain services must be included. Children under age 19 and pregnant women must be covered; and prenatal and delivery care for pregnant women, and ambulatory care for children must be provided. A State may elect to provide eligibility to certain additional groups, and may elect to provide certain additional services. In 1995, 43 States elected to have a medically needy program, and provided at least some services for at least some medically needy recipients. The remaining States utilized the “special income level” option (above) to assist other low-income persons who are aged and institutionalized.

Recent Changes to Eligibility Requirements

Welfare reform legislation enacted in 1996 (The Personal Responsibility and Work Opportunity Reconciliation Act) will change Medicaid eligibility requirements as States implement the new legislation. Many noncitizens (who might otherwise qualify for Medicaid) entering the country on or after August 22, 1996, are not eligible. However, the States have the option to continue coverage for most noncitizens who were already receiving Medicaid and to receive Federal matching funds.

The new legislation also eliminates the AFDC cash assistance program and replaces it with a block grant program called Temporary Assistance for Needy Families (TANF). However, families who met the AFDC eligibility criteria prior to welfare reform will usually continue to be eligible for Medicaid.

In most States, individuals who are eligible for SSI are also eligible for Medicaid. The law will result in some children losing SSI. Many of the children affected will still continue to be covered under Medicaid because they meet other Medicaid eligibility criteria.

Services

In order to receive Federal matching funds, the State programs must offer certain basic services. Within broad Federal guidelines, the States determine the amount and duration of services offered under their programs. They may limit, for example, the days of hospital care or the number of physician visits covered. However, some restrictions apply: Limits must result in a sufficient level of services to reasonably achieve the purpose of the benefits. Limits on required (nonoptional) services may not discriminate among beneficiaries based on medical diagnosis or conditions.

With certain exceptions, the States must allow Medicaid recipients freedom of choice among participating providers of health care services. States may pay for the services through various prepayment arrangements, such as an HMO. In general, States are required to provide comparable services to all categorically needy eligible persons.

The States may also receive Federal funding for providing other approved optional services. There are currently 34 optional services which may be provided with Federal support. The most common of these are diagnostic services, prescription drugs and prosthetic devices, clinic services, nursing facility services for the aged and disabled, intermediate care facilities for the mentally retarded, optometrist services and eyeglasses, rehabilitation and physical therapy services, and transportation services.

Additionally, States may also pay for home and community based care to certain persons with chronic impairments. Another option allows eight States (as a demonstration project) to pay for community supported living arrangement services for persons with mental retardation or a related condition.

Basic Medicaid Services

- Inpatient hospital services

- Outpatient hospital services

- Prenatal care

- Vaccines for children

- Physician services

- Nursing facility services for individuals aged 21 or older

- Home health care for persons eligible for skilled nursing services

- Family planning services and supplies

- Rural health clinic services

- Laboratory and X-ray services

- Pediatric and family nurse-practitioner services

- Federally qualified health center (FQHC) services and ambulatory and services of an FQHC that would be available in other settings.

- Nurse-midwife services

- Early and periodic screening, diagnosis, and treatment (EPSDT) services for children under age 21

Payment for Services

Medicaid operates as a vendor payment program, with payments made directly to providers who must accept the Medicaid reimbursement level as payment in full. Each State has broad discretion in determining (within federally imposed upper limits and specific restrictions) the reimbursement methodology and resulting rate for services, with two exceptions: For institutional services, payment may not exceed amounts that would be paid under Medicare payment rates; and for hospice care services, rates cannot be lower than Medicare rates.

States may impose nominal deductibles, coinsurance, or copayments on some Medicaid recipients. However, certain recipients are excluded: pregnant women, children under age 18, hospital or nursing home patients who are expected to contribute most of their income to institutional care, and categorically needy HMO enrollees. Emergency services and family planning services are exempt from copayments for all recipients.

The amount of total Federal outlays for Medicaid has no set limit (cap); rather, the Federal Government must match (at a predetermined percentage) the mandatory services plus the optional services the State decides to provide, and matches (at the appropriate administrative rate) necessary and proper administrative costs.

In 1995, total Medicaid payments averaged $3,311 per recipient. However, many Medicaid recipients require relatively small expenditures per person per year. For example, data indicate that Medicaid vendor payments for over 17 million children under age 21 averaged $1,047 per child. Other groups have very large expenditures per person. Over 151,000 recipients requiring ICF/MR care had average vendor payments of more than $68,600 per person (plus the cost of other services and acute care provided outside of the ICF/MR facility). Medicaid pays the medical costs of approximately 50% of persons with AIDS. A relatively small number of patients requiring very specialized and intensive medical care (for example, very premature babies and severely burned victims) can have expenses amounting to $4,000 per person per day. A few persons with continuing, extensive medical care needs (for example, high spinal cord or massive brain injuries) can require $100,000 of Medicaid vendor payments per person per year after year for decades.

Medicaid's compound rate of growth is projected to be 7.5% per year. If current expenditure trends continue, total payments (Federal and State) could increase to $230 billion by the year 2000.

| Category and service | Number of recipients (in thousands) | Total payments (in millions) | Average payment |

|---|---|---|---|

| Category | |||

| All recipients | 36,282 | $120,141 | $3,311 |

| Dependent children under age 21 | 17,164 | 17,976 | 1,047 |

| Adults in families with dependent children | 7,604 | 13,511 | 1,777 |

| Persons aged 65 or olde | 4,119 | 36,527 | 8,868 |

| Blind persons | 92 | 848 | 9,256 |

| Disabled persons | 5,767 | 48,570 | 8,422 |

| Other (unknown included)* | 1,537 | 2,708 | 1,762 |

| Service | |||

| General hospital | 5,581 | 26,331 | 4,735 |

| Mental hospital | 84 | 2,511 | 29,847 |

| Nursing facility | 1,667 | 29,052 | 17,424 |

| CF/MR | 15,326 | 10,383 | 68,613 |

| Prescribed drugs | 23,723 | 9,791 | 413 |

| Physician | 23,789 | 7,360 | 309 |

| Outpatient hospital | 16,712 | 6,627 | 397 |

| Home health | 1,639 | 9,406 | 5,740 |

| Other care | 11,416 | 9,214 | 807 |

| Clinical services | 5,322 | 4,280 | 804 |

| Laboratory and X-rays | 13,064 | 1,180 | 90 |

| Dental | 6,383 | 1,019 | 160 |

| Other practitioner | 5,528 | 986 | 178 |

| Family planning | 2,501 | 514 | 206 |

| Rural health clinic | 1,242 | 216 | 174 |

| EPSDT | 6,612 | 1,169 | 177 |

| Unknown | 6 | 101 | 17,549 |

| *Unknown numbers are high because Section 1115 (health care reform demonstrations) waiver data for Oregon and Tennessee were placed in the Unknown category. | |||

Financing and Administration

The portion of the Medicaid program that is paid by the Federal Government, known as the Federal Medical Assistance Percentage (FMAP), is determined annually for each State by a formula that compares the State's average per capita income level with the national average. By law, the FMAP cannot be lower than 50% nor greater than 83%. In 1997, the FMAPs vary from 50% (13 States and the District of Columbia) to 77.2% (Mississippi), with the average Federal share among all States being 57.0%. The Federal Government also reimburses States for 100% of the cost of services povided through facilities of the Indian Health Services.

The Federal Government also shares in the State's expenditures for administration of the Medicaid program. Most administrative costs are matched at 50% for all States. Depending on the complexities and need for incentives for a particular service, higher matching rates are authorized for certain functions and activities.

The Health Care Financing Administration (HCFA) within the Department of Health and Human services is the Federal agency that purchases health care services for the Medicaid program. HCFA administers the program from its headquarters in Baltimore, Maryland, and through 10 regional offices nationwide.

| Total outlays | 159,479 |

|---|---|

| Federal share | 89,029 |

| State share | 70,450 |

| Medical assistance payments | 151,817 |

| Federal share | 85,486 |

| State share | 66,331 |

| Administrative payments | 7,662 |

| Federal share | 3,543 |

| State share | 4,119 |